The annual company car tax in 2020 would be 20000 x 10 x 20 which is 400.

Electric car tax relief 2020.

Everything you need to know in this article we ll tell you everything you need to know about the federal tax credit available for 2020.

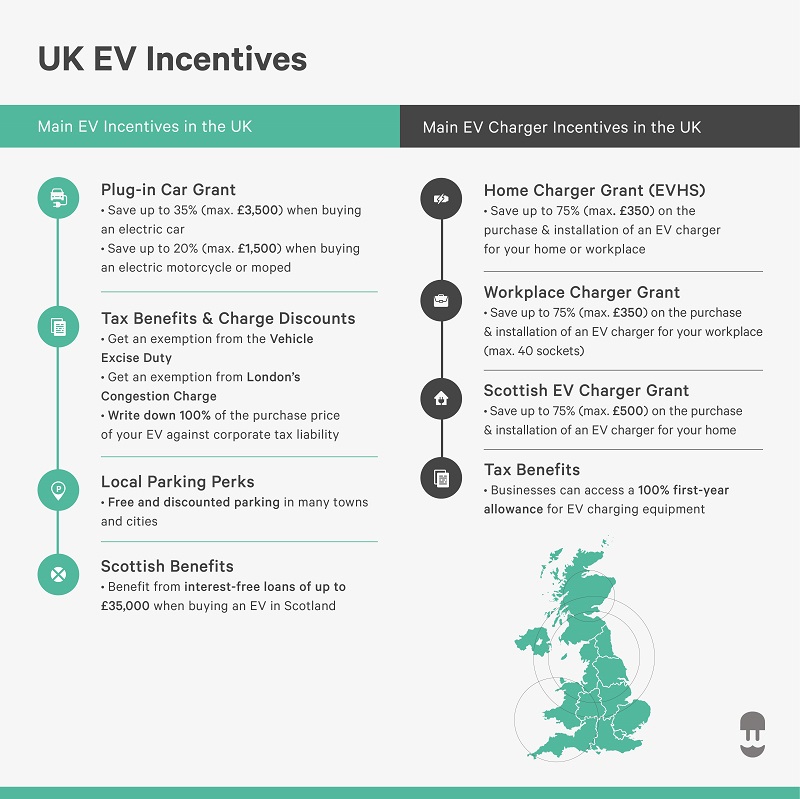

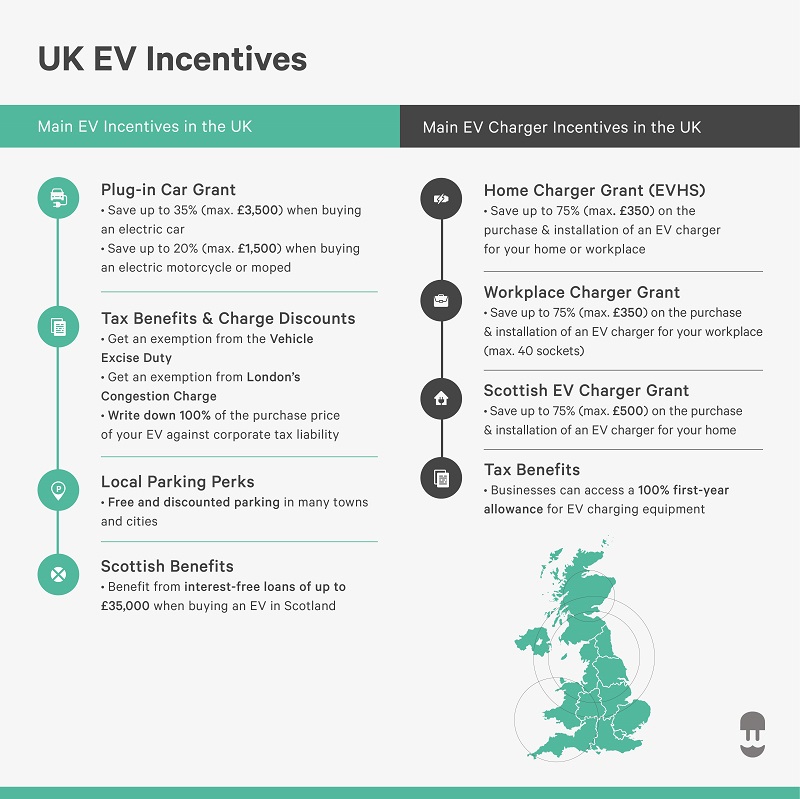

Earlier this year the government revealed electric vehicles will be exempt from company car tax in the 2020 21 tax year.

New and unused co2 emissions are 50g km or less or car is electric first year allowances.

04 01 tue mar 10 2020.

Federal tax credits for new all electric and plug in hybrid vehicles federal tax credit up to 7 500.

Electric vehicle tax credit.

All electric and plug in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7 500.

For company car drivers and fleet operators choosing an electric car from april 2020 there will be zero tax on benefit in kind bik during 2020 2021.

Electric car tax details on the car tax company car tax fuel duty and congestion charge payable for electric cars in uk.

Once an ev maker sells 200 000 eligible vehicles the federal tax credit goes away for vehicles sold by that car company.

The new company car tax band tables for 2020 to 2023 is set out below.

Tax changes which come into effect in 2020 2021 will help to reduce company car tax bills for drivers.

New and unused co2 emissions are between 50g km and 110g km.

As such company car drivers can save thousands of pounds a year simply.

In addition the government has introduced five new cct bands for plug in hybrid cars which emit 1 50g of co2 km which will further benefit those.

As a milestone decision this is the first opportunity for company cars to be taxed at 0 as a benefit in kind bik helping businesses make the transition to zero emission vehicles and a potentially emission free future.

Cars registered from april 6 2020.

I ve been driving an ev for several years now and have thoroughly researched state and federal tax credits and other incentives for a future purchase as well.

By luke chillingsworth published.

Description of car what you can claim.

From 6 th april fully electric cars will pay no company car tax cct in 2020 21 just 1 in 2021 22 and 2 in 2022 23.

Switching to an electric car can bring significant tax benefits for businesses and this is set to get even better from april 2020.

Financial year 2020 21 sees pure electric models zero rated for bik and these rates only climb to 1 and 2 for fy 21 22 and 22 23 respectively.

Car tax changes set to come into effect from april will be a welcome relief to many motorists according to electric car expert dan martin.

Tax changes from 2020 21.